Emergency Fund Basics

Welcome back to another topic under 30 Days of Money Management Tips! Today I wanted to discuss emergency fund basics.

Emergency Fund Basics

There are so many reasons why you should have an emergency fund. Dave Ramsay states “An emergency fund is a rainy day fund, an umbrella. It is for those unexpected events in life: a job loss, an unexpected pregnancy, a car transmission going out, and so on.”

Many experts suggest starting with a $1000 Emergency Fund

While everyone’s situation is different, I think this is a great starting goal. You have to start somewhere! If you have no savings to start with, $1000 can seem like a lot of money to save. I am going to provide a few tips below to help you achieve this!

In the event of an emergency, it is really beneficial to have $1000 set aside that you can access at any time. There is nothing more stressful than wondering how you are going to pay for something when you don’t have enough money.

While some people rely on credit cards for an emergency, it is much better to be able to pay cash for something. It can be easy to use a credit card for an emergency but hard to pay it off. Having enough cash for an emergency will help stay on budget and plan better.

Related:

- 7 Ways to Save $500 Right Now

- 17 Painless Ways to Save Over $300 in 30 Days

- How to Track Your Expenses

- Tips for a No Spend Day or Week or Month

- No Spend Day Tracker

Increase your emergency fund to 3+ months of your monthly expenses

Once you have put away $1000 into your emergency fund, keep increasing your emergency fund! One goal is to work on covering enough living expenses for 1 month. You never know when something unexpected can happen – a medical emergency, being laid off from a job or a housing expense.

I am currently in this phase. My goal is to actually put away about 8 months of living expenses by the end of the year. This is going to involve a lot of hard work on my part, but I anticipate a big change happening in my life at the end of this year. I want my emergency fund to consist of several months of savings that I can dip into if I need to.

Ways to save for an emergency fund

There are different ways of saving for an emergency fund. It really depends on how quickly and rapidly you want to grow your emergency fund.

Put away an extra paycheck

I get paid every other week which normally consists of 2 paychecks per month. I typically plan my monthly expenses based on the 2 paycheck system.

However there are a few months this year where I will have 3 paychecks in 1 month. I like to consider this an extra paycheck! I plan on putting away these extra paychecks into my emergency fund. This is an easy way to grow an emergency fund quickly without missing the extra money.

Put away bonuses, commission and side hustle

If you earn any extra income outside of your regular day job, like a side hustle, consider transferring a portion of it to your emergency fund. This is a great idea if you already contribute a percentage of your regular paycheck to your 401K or savings account and are feeling stressed about stretching your paycheck. By contributing extra income money to your emergency fund, you can add as much or as little as you feel comfortable with.

Use your tax return

Using your tax return to jump start or boost your emergency fund is one of the easiest ways to contribute to your emergency fund. While it can be tempting to spend your tax return on something fun, consider contributing 90% of your tax return to your emergency fund and spending the other 10%.

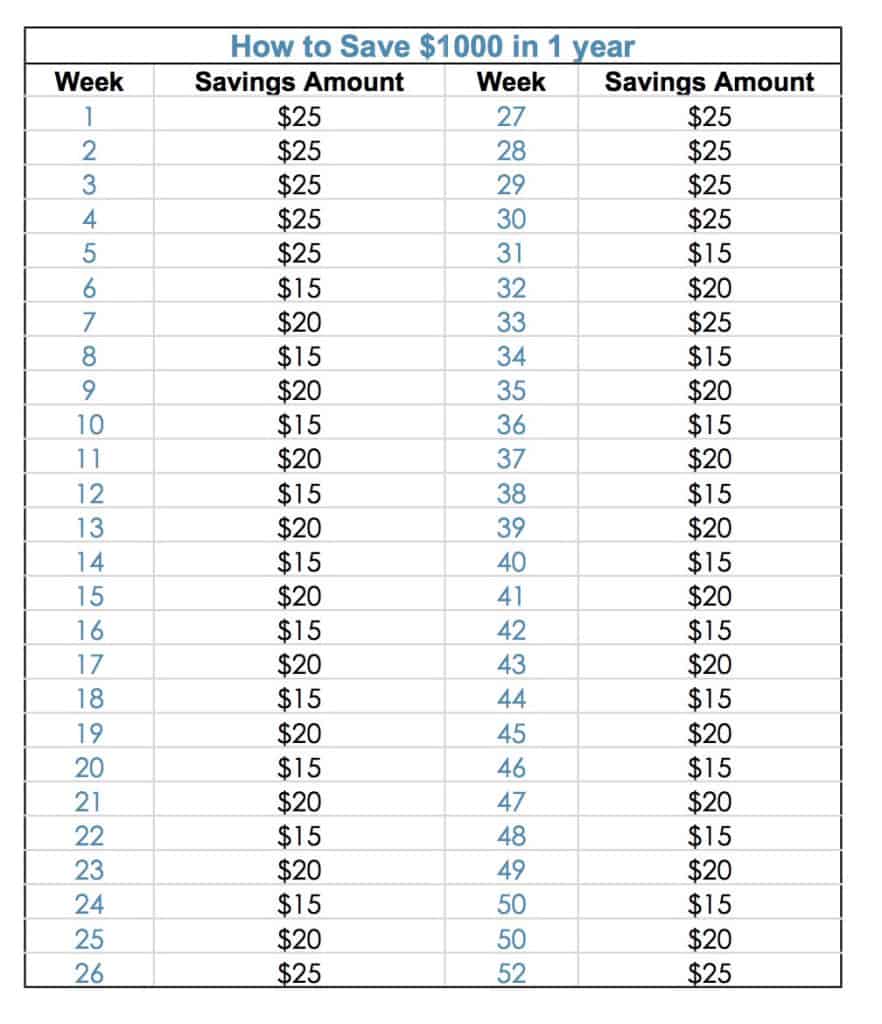

How to Save $1000 in 1 Year

I am following this simple chart I made using a spreadsheet. This is a slow and steady method of saving $1000 over the course of a year. As you can see, I never have to put more than $25 a week into this fund. Many of the weeks I only have to contribute $15!

Where to keep your emergency fund

It is important to be able to quickly access the money in your emergency fund. Some people choose to use a savings account for this reason. You can open a savings account at your bank where you already do business, or look online for an online savings account. Many online savings accounts will earn slightly higher interest than a traditional savings account at your local bank.

Open a Money Market Savings Account and earn higher interest rates than a traditional savings account. I currently use Betterment and love how easy the entire process is to use. I am able to decide how risky or conservative I would like my account to be and love monitoring my account.

Use the envelope system if you cash your paycheck each week. Some people might not advise this, but I know plenty of people who use the cash method for all their expenses. After each paycheck is cashed, simply transfer your money into an envelope designated for an emergency fund. This should be easy to do if you already designate your bills and expenses into different envelopes.

Great ideas on building up your emergency fund! I love the chart that you made on breaking down $1,000 into $15 or $25/week amounts.

Thanks Charissa! The chart has really helped make it easier for me to stick to!

You convinced me! I am printing it out now so I can follow it myself.

hmmmmmmm really awesome saving method….keep it up…..

thanks Sandy!

I really want to get an emergency fund going, but my husband insists it’s more important to pay off debt first and use credit as an emergency fund. I’m having trouble convincing him, but I’m working on it! We don’t have much (even $25 a week) to put aside right now anyway or I’d just do it myself 😉

I am in a similar situation with paying off my student loans or saving for an emergency. I have always relied on credit cards in the past for emergencies, but I really want to transition to using cash if I need to. I really stress about maxing out my credit cards again and being dependent on them!