Earning Passive Income With Dividend Investing

A great passive and proven way to supplement or even replace your income is with dividend investing. I haven’t talked much about dividend investing on the blog so far. This is why I wanted to explain how it works and the easiest way to get started.

Earning extra money is something I love to do, especially when it doesn’t involve a lot of work and time. I’m wrapping up my side hustle challenge and it was relatively easy money because selling stuff online doesn’t require much effort.

Those are the side hustles that I absolutely love. Don’t you agree?

The idea of earning passive or even semi-passive income can open up so many opportunities for you to do other things with your time.

You can start to design your day based on your own terms, whatever that may look like for you.

The following post is sponsored by Emperor Investments. All opinions are 100% my own. I choose to only work with companies I care about and benefits readers of Believe In A Budget.

So Wait, What is Dividend Investing?

When you invest in stocks, you are essentially buying a portion or a share of that company and becoming part-owner in a sense.

As a shareholder, you have the benefits of receiving dividends which is a portion of the company’s profits regularly throughout the year.

The amount in dividends that you receive depends on how much stock you own in a particular company along with how well that company is performing at the time.

Investing in stocks may seem risky to some people who fear they will lose money.

However, the stock market has historically yielded an average 8% return for the past 70 years.

This means that investors who are in it for the long run are bound to see a decent return on their investment contributions.

In fact, dividend investing is what most people rely on for retirement.

If you contribute to a 401(k) plan through your job, you’re likely already investing in stocks. This is a great way to grow a nest egg.

What some people don’t know is that depending on the vehicle that you use, dividend income can be used to fund other purposes.

A few examples are your child’s college tuition, cover start-up costs for a new business, or even replace your full-time job’s income.

The Problem I’ve Always Noticed With Investing

I’ve always known in the back of my head that investing was important.

I didn’t like how it always seems like such a tough concept to understand!

I felt like people who didn’t have a ton of money couldn’t invest or wouldn’t be able to find a financial advisor who would work with them.

In fact, most wealth management companies won’t work with people who don’t have at least $250,000 of assets.

Where does that leave the rest of us? If you have some extra money to save and invest each month, it’s important to know the best way to go about it.

This is why I’m thankful for platforms like Emperor Investments.

What Is Emperor Investments and How Can They Help You With Dividend Investing?

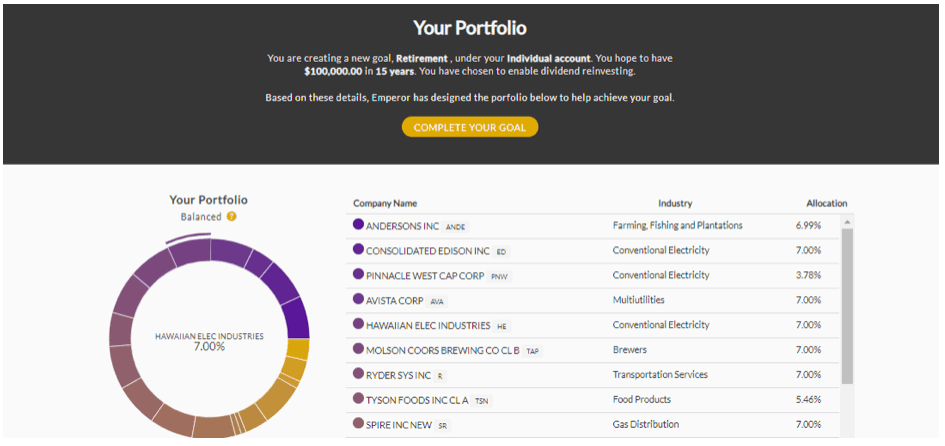

Emperor Investments is a robo-advisor who helps you choose your stocks and create an investment portfolio online based on your goals and risk tolerance.

Whether you’re just getting started or looking for a low-cost and easy way to manage your investments, Emperor aims to provide the solution.

What sets them apart from other robo-advisors I’ve seen is that they use a combination of passive and active¹ investing strategies while still providing you with a hands-off approach to managing your portfolio.

They create a healthy mix between investing in certain funds that you can hold long-term for maximum growth and also actively buying and selling individual securities.

Emperors’ founders worked in the financial services industry for several years so they’ve merged their know-how of the market. Their technology that helps you pick quality companies to invest in without having to worry about managing it all and picking the right strategy.

They do the work in terms of reviewing each company’s quarterly reports they can recommend investing in stocks with companies who have a long and consistent dividend payout history.

How to Use Emperor Investments for Dividend Investing

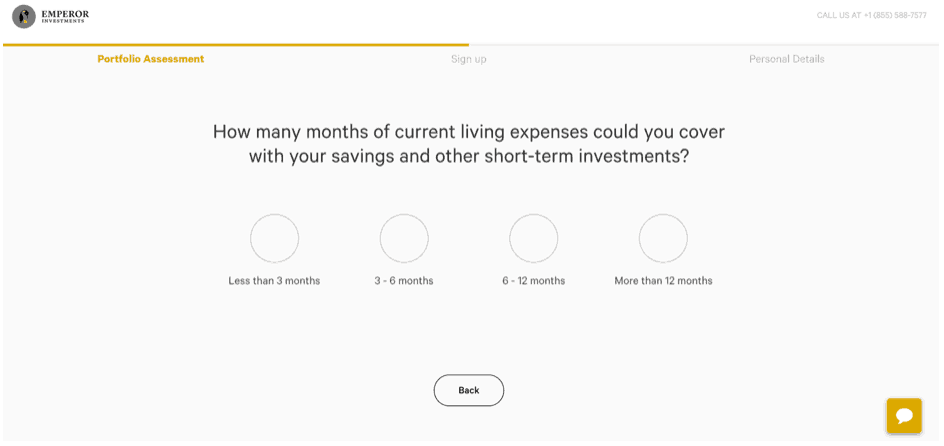

You can set up a free account with Emperor Investments by answering a few quick questions. The questionnaire will ask you your age, income, and prompt you to share a little more info about your specific goals.

This helps the system determine your preferred risk level² which will help the algorithm in terms of picking the best stock options for you.

What I love about this company is that you can always talk to a person on the phone as well but I do appreciate the fact that the online set up process is super smooth and easy to navigate.

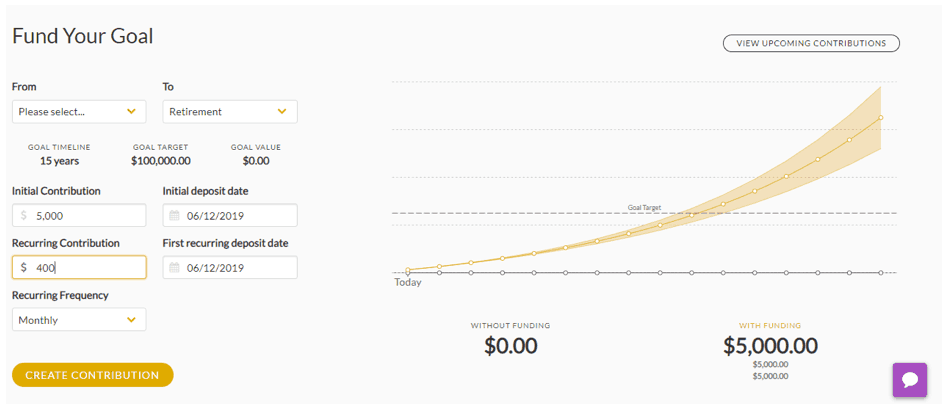

As you make contributions, you’ll be able to log in regularly to review your portfolio.

This is great for goal-tracking especially if you’re planning for retirement like many of us are.

It’s important to know what your goal is and how much you should be saving. Be sure to take advantage of Emperor’s retirement calculator³.

Does Emperor Investments Have Fees?

Yes, like most other robo-advisors, Emperor does charge a small fee to manage your portfolio and suggest stock investments.

However, this management fee is much less than what you’d pay if you hired an investment advisor. If your balance is under $100,000, you’d pay 0.60% annually.

The fee actually goes down as your balance grows.

- $100,001-$300,000 0.50% annually

- $300,001-$600,000 0.40% annually

- $600,001-$900,000 0.30% annually

- >$900,001 0.20% annually

Can I Use This Platform If I Have Another Account Somewhere Else?

Of course. You can also transfer your investments to Emperor so that everything is in one place.

How Much Does it Cost to Get Started?

You need a minimum of $500 to open an account and start investing. From there you can set your goals and see how much you need to contribute regularly.

Worried about having your first $500 to invest?

Make it a fun mini-goal by utilizing some of my favorite tips to help you save and earn more.

Check out:

Get started with Emperor Investments and start earning passive income. Investing can definitely be added to your list of income streams to help diversify your income. Plus the sooner you start saving, the more you can earn!

Thanks for the tips!

🙂